EXPLAINER: Railroads and The Supply Chain

“Rail is stepping up, ready to do its part. We’ve been operating 24/7 for some time. We’ve got capacity. We want to move freight. So we’re prepared to do our part to keep things moving through peak season.”

— Ian Jefferies, president and CEO of the Association of American Railroads, on Yahoo Finance following the October 13 announcement that the Port of Los Angeles would extend its hours.

Washington, D.C. — For weeks now, the challenges facing the U.S. and global supply chains have pervaded headlines. This logjam—looming over the holiday shopping season—culminated in an announcement this week from the White House that it had convened supply chain stakeholders and facilitated steps to ease congestion.

Here’s a breakdown of the situation from a rail perspective, including what railroads are doing to maximize throughput and address the challenges they confront as the “middle miles” of the U.S. supply chain.

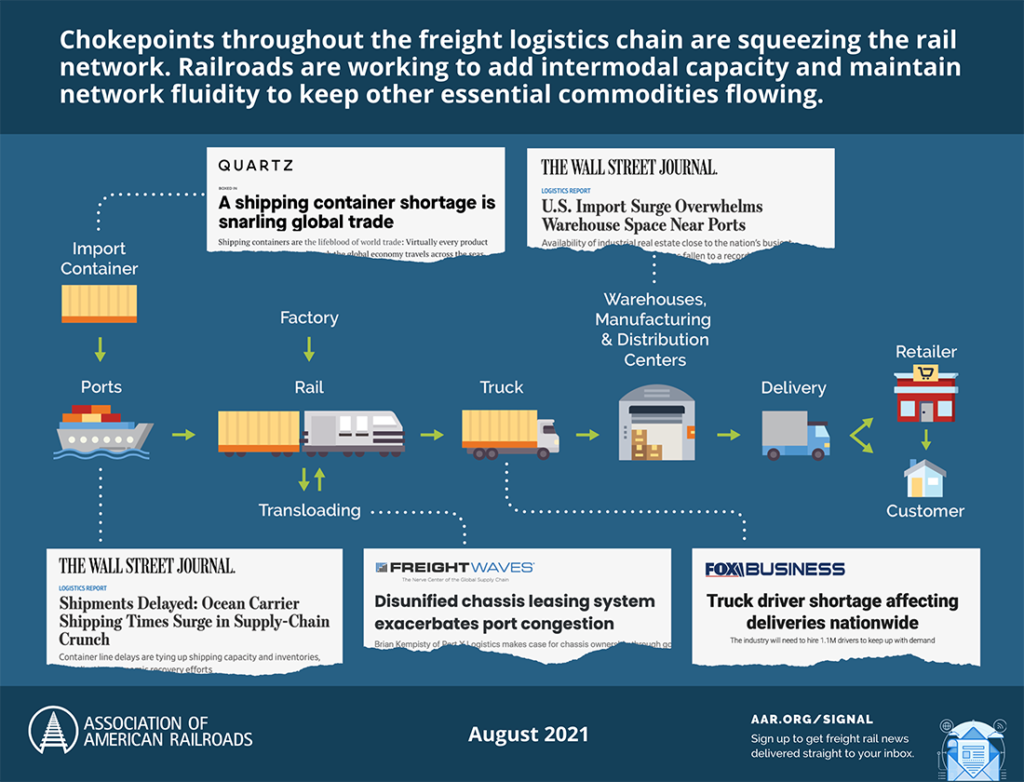

Where are we and how did we get here? To set the scene—at writing there are some 60 container ships awaiting berth at the Ports of Los Angeles and Long Beach; truck and truck driver shortages across the country; and a lack of warehousing and terminal space for storage. These issues were driven by several factors, from pandemic-related manufacturing disruptions to trade disputes to weather events.

Where are we and how did we get here? To set the scene—at writing there are some 60 container ships awaiting berth at the Ports of Los Angeles and Long Beach; truck and truck driver shortages across the country; and a lack of warehousing and terminal space for storage. These issues were driven by several factors, from pandemic-related manufacturing disruptions to trade disputes to weather events.

Rail role = steady middle miles: Railroads are typically the middle piece of the supply chain, an important conduit for freight between port and last-mile truck service. They move about 40% of long-distance U.S. freight. As such, railroads are confronting challenges “on both the port side and then the offloading side with our partners.”

An anecdote: “One of our railroads had over 20 intermodal trains—think about that, that’s 20 trains with approximately 200 containers, so about 4,000 containers—sitting outside the Chicago terminal, waiting to get into the yard to unload, but couldn’t do so because the outgates aren’t being picked up—local trucking isn’t able to get that out. That just goes to show you how quickly things can start backing up,” explained AAR’s Jefferies in a recent podcast.

All in this together: Freight railroads together with trucks, ships and barges deliver 61 tons of goods per American every year. Disruptions to any one part of this integrated network spill across it. So while railroads can’t control challenges like chassis shortages, they can and have maximized their capacity and worked with partners to offer creative solutions.

Keep it flowing: Railroads have long operated 24/7, so the news of expanded hours at the West Coast ports is welcome. To maximize throughput further they’ve added capacity, in some cases reopening offline intermodal facilities or even paving over tracks in yards to create additional storage. Railroads also collaborate with shipping partners to keep goods flowing around the clock, for example offering incentives for night and weekend pick-ups.

A steel-wheeled stalwart: A study from the Northwestern University Transportation Center (NUTC) found that railroads were nimble in handling supply-chain disruptions and helped stabilize the intermodal market when trucking could not. Indeed, in the first half of 2021, railroads carried greater intermodal volume than ever.

Looking ahead: Amid the economic recovery and traffic changes due to sharp increases in e-commerce, resilient railroads are poised to keep delivering. “Post-pandemic, freight rail can lead the logistics industry and its customers forward in what is certain to be a volatile future,” noted the NUTC researchers.

The policy takeaway: Right now, lawmakers in Congress could take a step toward mitigating future supply chain problems by passing the bipartisan infrastructure bill. Moving forward, as the competitive environment for freight transport tightens, regulators must take care to strike the right balance. A lack of regulatory parity across modes could push freight from rail to road and exacerbate supply chain chokepoints in the future.